Over the last decade, emerging markets (EM) were a synonym for economic dynamism, opportunity and growth. In fact, EM economies have been outperforming most other countries when it comes to GDP expansion and other activity metrics until the beginning of 2020. However, this multi-decade picture has changed markedly with the turnaround brought by the Covid-19 pandemic. Following the shock caused by the global spread of Covid-19, EM countries suffered from below average growth and subdued performance on a relative basis vis-à-vis advanced economies. Main reasons for this were initially low vaccination rates, supply chain constraints, and less accommodative monetary as well as fiscal policies. The major slowdown of China also added to the EM macro headwinds.

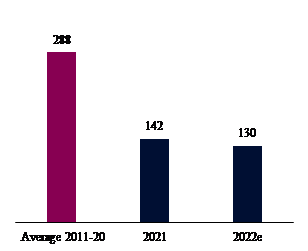

EM vs advanced economies growth differential

Sources: IMF, QNB analysis

The growth differentials between EM and advanced economies is estimated to have narrowed in 2021 and 2022, significantly below historical norms (see graph). This means that, on average in the last two years, EM countries grew only around 1.3% and 1.42% faster than advanced economies. This stands in stark contrast to the usual 2.88% of outperformance. Narrower growth differentials point to a slower catch up or growth convergence towards the higher levels of economic output, productivity and standards of living found in advanced economies.

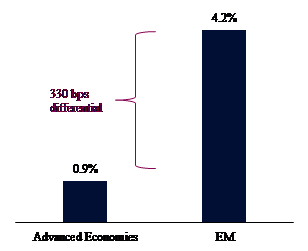

In our view, however, the bout of EM underperformance is about to end, with growth accelerating to 4.2% this year from 3.7% in 2022, while advanced economies are set to slow to 0.9% from 2.6% in the same period. This would support a 330 bps growth differential in favour of EM versus advanced economies, 42 bps above the long-term average.

Forecasted 2023 GDP growth

Sources: QNB analysis

Two main factors explain the likely return of EM outperformance in 2023.

First, macroeconomic fundamentals are back again stronger in most EM than advanced economies. Several advanced economies have been accumulating acute imbalances from excessive policy stimulus following the pandemic and the Russo-Ukrainian War. This was due to the bottom-up pressures to protect the income of households and corporates from large negative shocks. In contrast, most EM countries had less policy space and were more disciplined in adjusting to economic conditions, responding more immediately to runaway inflation and getting it under control before their economies overheated too much. As a result, EM countries are now under less pressure to tighten policy and their economies already largely adjusted to less benign global conditions.

Second, the slowdown in China was a particularly strong headwind to EM countries in 2022. This is due to both the relative size of the Chinese economy within the EM universe and its direct and indirect trade and financial links with other EM. China’s economy represents about 1/3 of total EM GDP. Moreover, Chinese growth has a high multiplying effect, often spilling over to Emerging Asia and EM commodity exporters. Thus, the slowdown of growth in China last year, precipitated by Zero Covid policies and the lagged effects of a significant tightening in monetary, fiscal and regulatory policies in 2021, indirectly affected the economic performance of EM. Chinese GDP growth slid from over 8% in 2021 to 3.2% last year. In 2023, however, China is expected to be a tailwind to EM, as its economy is set to fully re-open from Covid policies and authorities will press ahead with fiscal as well as monetary stimulus measures. This will support a significant acceleration of Chinese growth to a more normal 5.5% rate. ro backdrop, global conditions are particularly benign for net commodity exporters that run current account surpluses, such as the countries of the Gulf Cooperation Council (GCC).

This is because they are benefitting from still elevated commodity prices, which supports both external and government revenues. This is even more beneficial in a period when international liquidity is tighter and borrowing costs are high, as it allows for continuing expenditure, investments and growth. In contrast, conditions are less benign for net commodity importers, particularly if they run current account deficits and need to rely on constant external funding to maintain a certain level of consumption and investment.

All in all, the causes for the relative underperformance of EM in recent years are starting to erode. Most EM countries currently have better fundamentals than advanced economies and the Chinese economic recovery is set to support higher EM growth rates. Net commodity exporters that run current account surpluses are particularly well positioned to capitalize on the more positive environment.

Was this information helpful?